KL Allocation Fund

GAVIX $11.16  0.03

0.03

As of 7/26/2024

Fund Description and Objective:

The KL Allocation Fund seeks long-term capital appreciation with an emphasis on capital preservation.

The fund invests in the equities of Knowledge Leaders, those companies that possess deep reservoirs of intangible capital as a result of their history of investing in knowledge-intensive activities like R&D, brand development and employee education. Academic research has proven highly innovative companies have a tendency to generate excess returns in the stock market, and it is these excess returns the investment team aims to capture in the portfolio.

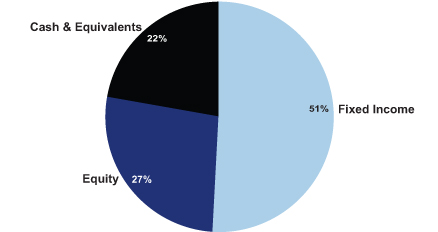

The fund employs an allocation strategy, investing in three asset classes depending on market factors: equities, fixed income and cash.

Key Facts

Inception Date:

|

9/30/2010

|

As of 3/31/24, the 1-year, 5-year, 10-year and since inception annualized total returns were 5.82%, 3.13%, 3.50% and 5.39%, respectively. Based upon the Fund’s current prospectus, the net and gross total operating expense of the fund are 1.28%/1.35%. The net annual expenses include the acquired fees and expenses but deducts the expense waivers being provided. The net annual expenses benefit from expense waivers that may not require reimbursement. The board of trustees intends to provide the waivers until 12/31/2024, subject to change. The inception date for the KL Allocation Fund is 9/30/10. Past performance is no guarantee of future results. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. Market performance does not represent the returns you would receive if you traded shares at other times. For the fund’s most recent performance please visit www.knowledgeleadersfunds.com. Performance may reflect fee waivers in effect; in their absence, the rate of return may have been lower. Client Forms See Definitions, Terms & Conditions Please consider the Fund’s investment objectives, risks, charges and expenses before investing. The prospectus or summary prospectus that contains this and other information about the Fund, is available by calling 888.998.9890 and should be read carefully. The value of the securities held by the Fund will change due to general market and economic conditions and industry perceptions. Investments in non-US issuers may involve unique risks. Currency fluctuation, adverse political, economic or social developments could undermine the value of the Fund’s investments. The securities of mid-cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes. Many of the risks with respect to foreign investments are more pronounced for investments in issuers in developing or emerging market countries. An investment in a fund that is less diversified across countries or geographic regions is generally riskier than an investment in a more geographically diversified fund. Portfolio composition will change due to ongoing management of the Fund. References to specific securities or sectors should not be construed as recommendations by the Fund, its Advisor or Distributor. US Fund Tactical Allocation is the Morningstar category average. Morningstar Tactical Allocation portfolios seek to provide capital appreciation and income by actively shifting allocations across investments. These portfolios have material shifts across equity regions, and bond sectors on a frequent basis. To qualify for the tactical allocation category, the fund must have minimum exposures of 10% in bonds and 20% in equity. Next, the fund must historically demonstrate material shifts in sector or regional allocations either through a gradual shift during three years or through a series of material shifts on a quarterly basis. Within a three-year period, typically the average quarterly changes between equity regions and bond sectors exceeds 15% or the difference between the maximum and minimum exposure to a single equity region or bond sector exceeds 50%. Market Turbulence Resulting from COVID-19. The outbreak of COVID-19 has negatively affected the worldwide economy, individual countries, individual companies and the market in general. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Fund. The KL Allocation Fund is distributed by IMST Distributors, LLC. Subscribe to Email Updates By submitting this form you acknowledge our privacy/data collection policy. KL Allocation Fund Knowledge Leaders © 2024 Knowledge Leaders Capital, LLC – All rights reserved | info@klcapital.com(as of 3/31/2024)

(as of 3/31/2024)

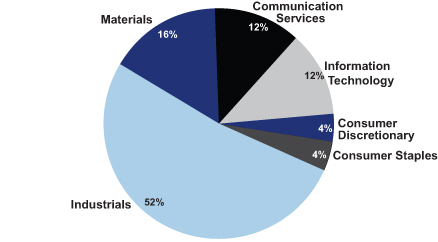

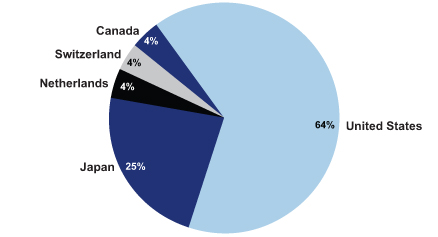

(as of 3/31/2024)

Equity Securities

% of Net Assets

ASICS CORP

1.19

WATSCO INC

1.16

KURARAY CO LTD

1.15

HITACHI LTD.

1.14

EATON CORP

1.13

FUJI MEDIA HOLDINGS INC

1.12

INGERSOLL-RAND CORP

1.12

WW GRAINGER INC COM

1.12

AMPHENOL CORP NEW CL A

1.11

PARKER HANNIFIN CORP

1.10

WABTEC

1.09

VULCAN MATERIALS CO.

1.09

IAC/INTERACTIVECORP

1.09

MARTIN MARIETTA MATERIALS INC.

1.09

DAICEL CORPORATION

1.09

SNAP-ON INC

1.07

ROKU INC

1.07

SYNOPSYS INC

1.07

AMETEK INC NEW COM

1.07

ASM INTL NV

1.06

CSW INDUSTRIALS INC

1.06

AJINOMOTO CO INC

1.06

ABB LTD

1.06

SIMPSON MANUFACTURING CO INC

1.06

STANTEC INC

1.05

The Knowledge Effect is the tendency of highly innovative companies to generate excess returns in the stock market. It is a market anomaly based on decades of academic research. To learn more, read our white paper, The Knowledge Effect: Excess Returns of Highly Innovative Companies.

![]()

![]()

Global Balanced Strategy![]()

Developed World ETF

Global Equity Strategy