(as of 4/26/2024)

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. NAV prices are used to calculate market price performance prior to the date when the Fund first traded on the New York Stock Exchange. Market performance is determined using the bid/ask midpoint at 4:00pm Eastern time, when the NAV is typically calculated. Market performance does not represent the returns you would receive if you traded shares at other times. For the fund’s most recent month end performance, please visit www.knowledgeleadersfunds.com/kldw. Performance may reflect fee wavers in effect; in their absence, the rate of return may have been lower. The NAV is the ETF’s value per share. The market price is the price that the ETF share currently trades in the secondary market. Please consider the Fund’s investment objectives, risks, charges and expenses before investing. The prospectus or summary prospectus that contains this and other information about the Funds is available by calling 844-428-3525 and should be read carefully. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. Currency Risk is the risk that the values of foreign investments may be affected by changes in the currency rates or exchange control regulations. Investments in foreign securities may involve risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid and more volatile than securities markets in more developed markets. The Fund’s return may not match or achieve a high degree of correlation with the return of the Index. Holdings are subject to change. Knowledge Leaders Developed World ETF is distributed by IMST Distributors, LLC Shares of the Funds may be sold throughout the day on the exchange through any brokerage account. However, shares are not individually redeemable, and may only be redeemed directly from the Fund by Authorized Participants, in very large creation/redemption units. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Shares may trade above or below NAV. KL Allocation Fund Knowledge Leaders © 2024 Knowledge Leaders Capital, LLC – All rights reserved | info@klcapital.comFUND DOCUMENTS

![]() Q1 2024 Fund Commentary

Q1 2024 Fund Commentary

![]() Portfolio Holdings

Portfolio Holdings

![]() Prospectus

Prospectus

![]() Summary Prospectus

Summary Prospectus

![]() SAI

SAI

![]() Semi-Annual Report

Semi-Annual Report

![]() Annual Report

Annual Report

![]() SOI Fiscal Q1

SOI Fiscal Q1

![]() SOI Fiscal Q3

SOI Fiscal Q3Knowledge Leaders Developed

World ETF

KLDW: $43.12

KLDW: $43.12

NAV as of 4/26/2024Fund Description and Objective

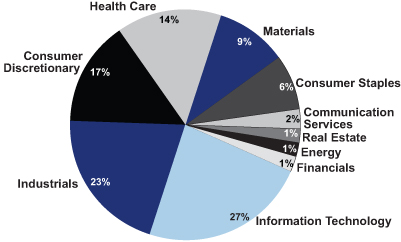

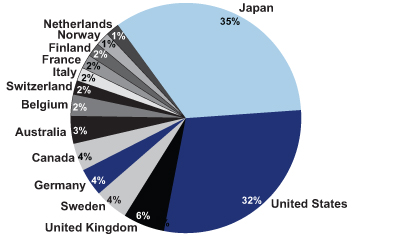

The Knowledge Leaders Developed World ETF seeks long-term capital appreciation by investing in equities of highly innovative companies in the developed world. It is an actively managed exchange-traded fund.The fund invests in Knowledge Leaders, those companies that possess deep reservoirs of intangible capital as a result of their history of investing in knowledge-intensive activities like R&D, brand development and employee education. Academic research has proven highly innovative companies have a tendency to generate excess returns in the stock market, and it is these excess returns the investment team aims to capture in the portfolio.

The team selects a diversified mix of the most liquid large- and mid-cap Knowledge Leaders from the developed world, including North America, Europe and Asia. Recommended for core exposure to developed world equities.

Key Facts

Ticker:

Asset class:

Morningstar Category:

Inception:

Expense ratio:

Net Assets:

Shares outstanding:

Number of holdings:

Primary exchange:

CUSIP:

NAV:

Market Price (daily change):

Premium/Discount:

Bid/Ask Midpoint:

Bid/Ask Premium/Discount:

30-Day Median Bid/Ask Spread:

Portfolio Manager:

KLDW

Equity

Global Large-Stock Blend

07/07/2015

0.75%

$131,505,167

3,050,001

102

NYSE Arca

46143U849

$43.12

$43.18 | 0.33%

$0.06 | 0.14%

$43.18

$0.06 | 0.13%

0.07%

Steven Vannelli, CFA

(as of 3/31/2024)

Equity Securities

% of Net Assets

SCREEN HOLDINGS CO LTD

1.77

HARVEY NORMAN HLDG

1.72

ATLAS COPCO AB-A SHARES

1.62

AMPHENOL CORP NEW CL A

1.61

VOLVO AB

1.60

SAGE GROUP PLC

1.47

SECOM CO LTD

1.45

GSK PLC

1.44

KAO CORP

1.40

ACCENTURE LTD

1.39

BEIERSDORF AG

1.36

AGILENT TECHNOLOGIES INC

1.34

SEKISUI CHEMICAL CO LTD

1.30

SAP AG

1.30

SANWA HOLDINGS CORP

1.29

ECOLAB INC COM

1.27

GARMIN LTD SHS

1.26

ANALOG DEVICES INC

1.26

GENUINE PARTS CO

1.26

FIRSTSERVICE CORP

1.23

TOKYO OHKA KOGYO CO LTD

1.22

THERMO FISHER SCIENTIFIC INC.

1.22

ARISTOCRAT LEISURE LTD.

1.21

TRANE TECHNOLOGIES INC

1.21

RESONAC HOLDINGS-SHOWA DENKO KK

1.18

The Knowledge Effect is the tendency of highly innovative companies to generate excess returns in the stock market. It is a market anomaly based on decades of academic research. To learn more, read our white paper, The Knowledge Effect: Excess Returns of Highly Innovative Companies.

![]()

Global Balanced Strategy![]()

Developed World ETF

Global Equity Strategy